Project Purpose and Goal

Designed the architecture and lead a team of 8 developers to create core features and integrate third party APIs. Integrated machine learning enabled micro-services to calculate credit scores, estimate property values and yield mortgage offers. Leveraged Google Maps API and TensorFlow API.

Web Stack and Explanation

Built the project using Next.js because of its powerful server-side rendering and dynamic routing. The backend is fully serverless, it handles automated magic link emails (Postmark), auithentication using JWT and Passport, Airtable CRM, and connects to the propietary credit-score and property-estimation microservices (Elastic Beanstalk / Google Maps / TensorFlow).

For the databse I used PostgreSQL and Prisma ORM. I generated the GraphQL schema using Nexus.

To ensure code/platform stability, I Implemented a CI/CD pipeline with Jest for unit testing, Cypress for End to End, Typescript type-checking, database migration, code linting and preview deploys. Finally, I deployed the site to Vercel

Problems and Thought Process

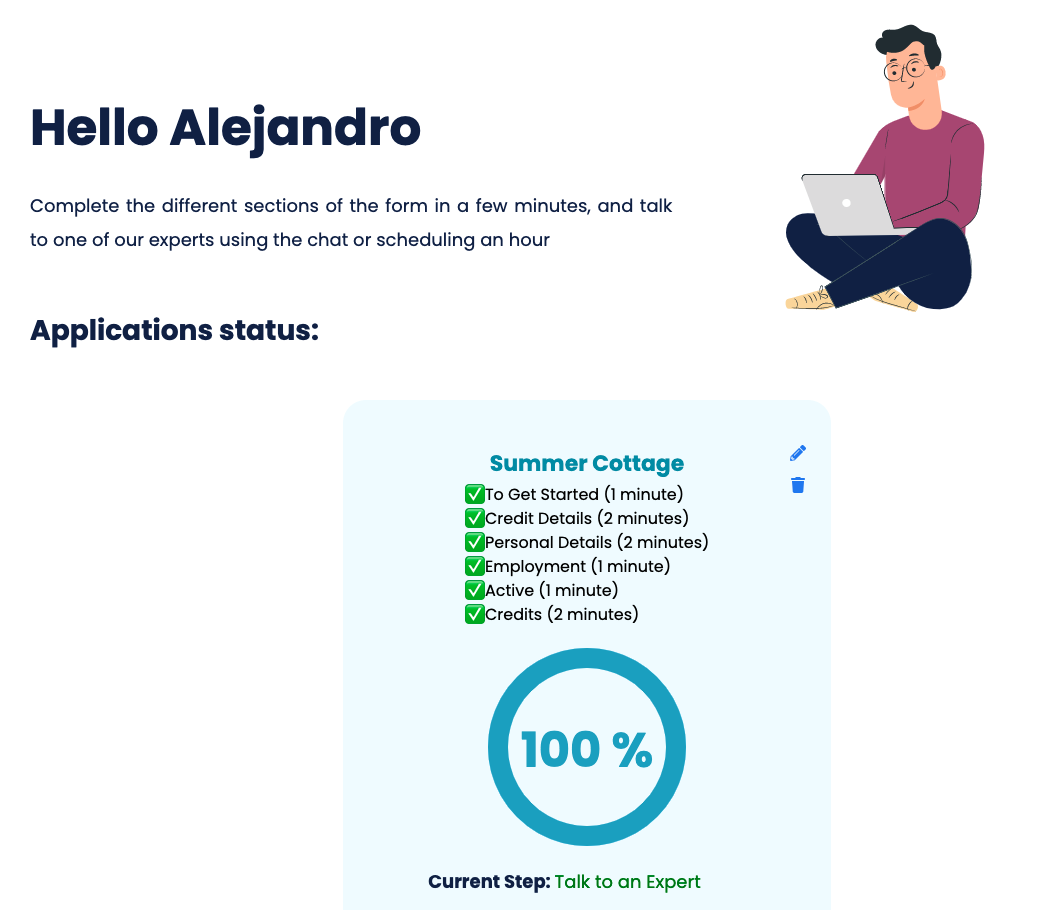

The client requested me to develop the platform from scratch. I worked with them to detemine the core features and presented a plan. After the user is authenticated, they're able to fill a multi part form. After the forms are completed, a serverless function makes a request to determine a credit score, estimate the value of the property and match the client to the best suited financial institution.

The main goal of the project was to make it scalable and flexible enough so that it would support future partners and integrate with existing fintech platforms to monetize the user base.